Launching your small business is exciting, but let’s be honest—taxes can be intimidating. Whether you’re just starting out or looking to improve your processes, understanding how taxes work can save you time, stress, and money.

At Tax Goals Hub, we’re all about simplifying finances and helping Florida businesses thrive. With our new website launch, we’re bringing expert tips and tools right to your fingertips. To kick things off, here are 5 essential tax tips every Florida business owner should know.

-

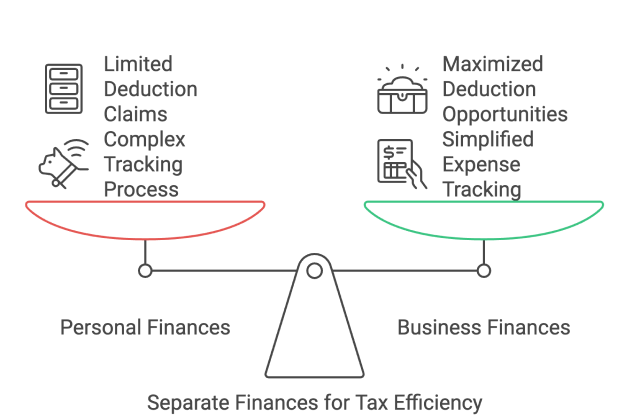

- Keep Personal and Business Finances Separate

Mixing your personal and business finances can create a lot of confusion—not to mention a headache when it’s time to file taxes. Open a dedicated business bank account to keep things organized.

- Keep Personal and Business Finances Separate

-

- Why it matters: It’s easier to track expenses and claim deductions when your business spending is separate.

-

- Pro Tip: Use a business credit card to streamline your spending records.

-

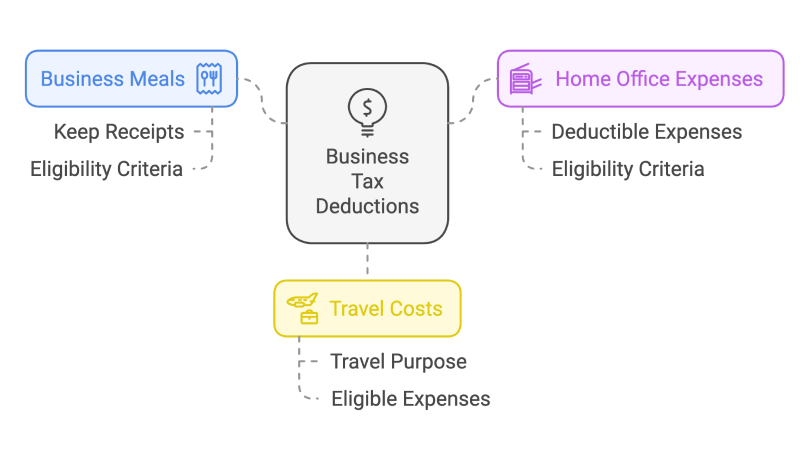

- Understand Your Deductions

Did you know that you can deduct more than just office supplies? Florida businesses may be eligible for deductions like:

- Understand Your Deductions

-

- Business meals (keep those receipts!).

-

- Home office expenses (if you work from home).

-

- Travel costs related to your business.

-

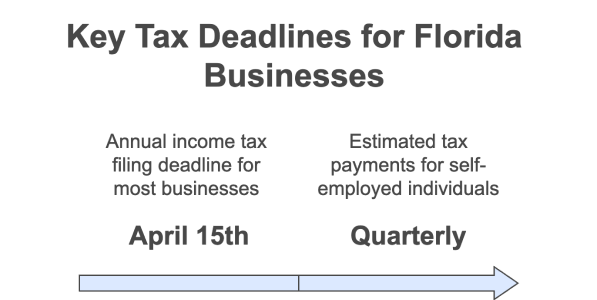

- Know Your Tax Deadlines

Florida doesn’t have a state income tax (hooray!), but there are still important federal deadlines you need to remember. Key dates include:

- Know Your Tax Deadlines

-

- Quarterly estimated taxes for self-employed individuals.

-

- Annual income tax filing deadlines (April 15th for most businesses).

Pro Tip: Set calendar reminders or use tax software to stay on top of due dates.

-

- Take Advantage of Digital Tools

Gone are the days of shoeboxes full of receipts. Digital tools make managing your taxes easier than ever.

- Take Advantage of Digital Tools

-

- Software to try: TurboTax, QuickBooks, or FreshBooks.

-

- Features to look for: Expense tracking, tax calculations, and integration with your bank accounts.

Pro Tip: Schedule a free consultation through our new website to learn how we can help you simplify your taxes.

-

- Partner with a Tax Professional

Let’s face it—taxes are complicated, and not everyone has the time or expertise to handle them. That’s where we come in. At Tax Goals Hub, we help small businesses navigate the complexities of taxes, so you can focus on what matters: growing your business.

- Partner with a Tax Professional

Why it matters: A tax professional ensures accuracy, identifies savings opportunities, and keeps you compliant.

Pro Tip: Schedule a free consultation through our new website to learn how we can help you simplify your taxes.

Why Tax Goals Hub Is Here for You

With the launch of our brand and website, Tax Goals Hub LLC is bringing tailored tax and financial services to small business owners across Florida. Our mission is simple: to empower you with clarity and confidence.

Explore our new website, discover more resources, and schedule your free consultation today. Let’s make taxes the easiest part of your business!

Taxes might not be the most exciting part of running a business, but they don’t have to be stressful. With these tips and the right support, you’ll be ready to tackle tax season like a pro.

Welcome to the Tax Goals Hub family—where we simplify finances and empower businesses just like yours.